All Categories

Featured

Table of Contents

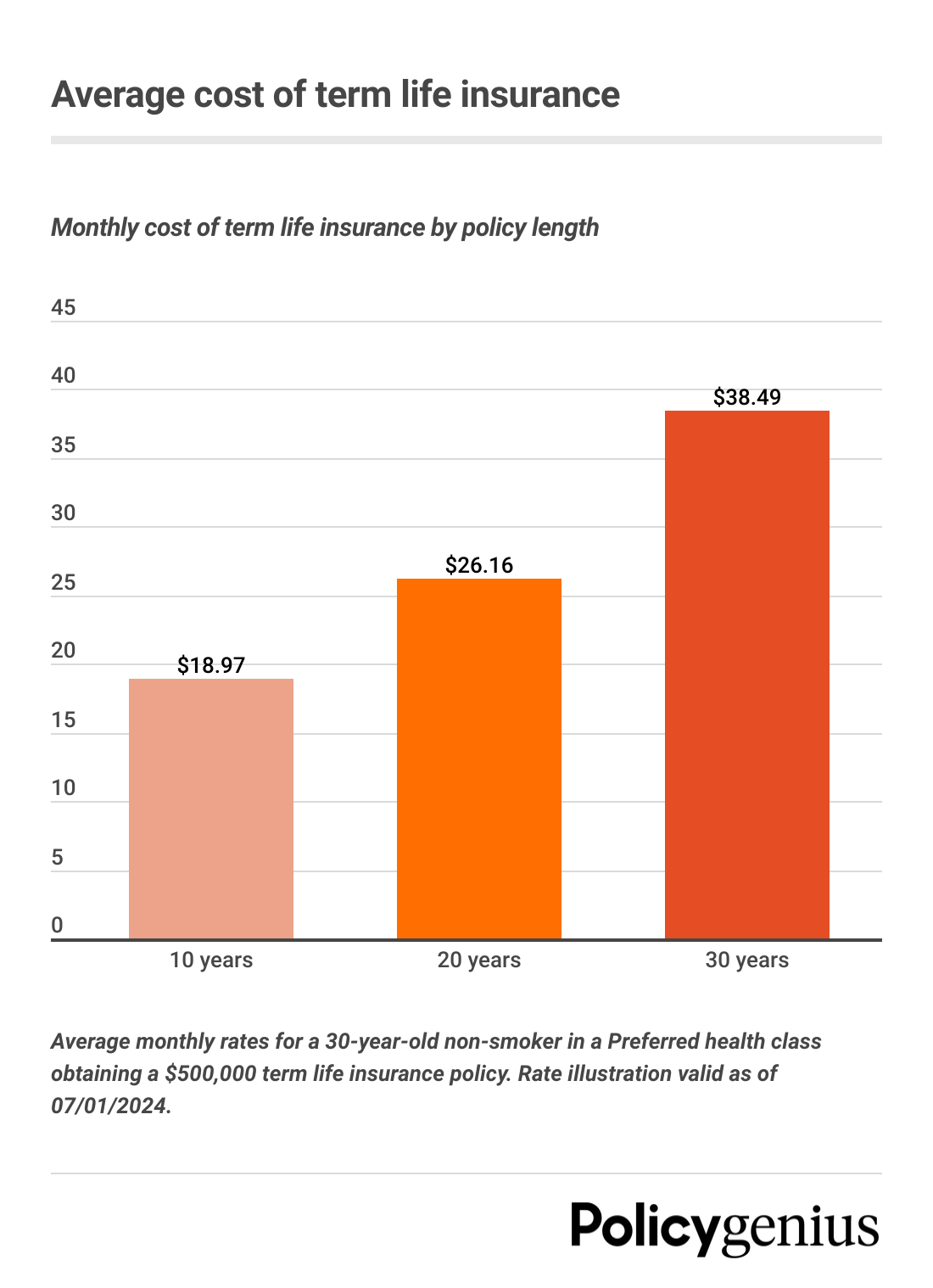

A level term life insurance coverage plan can offer you assurance that the people that depend on you will have a survivor benefit throughout the years that you are preparing to support them. It's a means to help take treatment of them in the future, today. A level term life insurance policy (in some cases called level costs term life insurance policy) plan gives insurance coverage for an established number of years (e.g., 10 or 20 years) while maintaining the premium settlements the same for the duration of the plan.

With level term insurance coverage, the cost of the insurance will remain the exact same (or potentially lower if returns are paid) over the term of your policy, generally 10 or 20 years. Unlike long-term life insurance policy, which never ever runs out as lengthy as you pay premiums, a degree term life insurance policy will finish at some time in the future, generally at the end of the duration of your degree term.

What is Term Life Insurance For Spouse? An Essential Overview?

Since of this, lots of people make use of permanent insurance as a steady monetary preparation tool that can offer several demands. You may have the ability to transform some, or all, of your term insurance coverage throughout a set duration, commonly the first one decade of your policy, without requiring to re-qualify for coverage even if your wellness has changed.

As it does, you may desire to include to your insurance policy protection in the future - What is a level term life insurance policy. As this happens, you might want to at some point reduce your death benefit or consider converting your term insurance policy to a long-term policy.

So long as you pay your premiums, you can rest very easy recognizing that your liked ones will obtain a death advantage if you die during the term. Lots of term plans allow you the capability to convert to permanent insurance policy without needing to take another wellness examination. This can allow you to take advantage of the extra advantages of a long-term plan.

Level term life insurance policy is just one of the easiest courses right into life insurance coverage, we'll review the benefits and drawbacks to make sure that you can choose a strategy to fit your demands. Degree term life insurance is the most typical and basic kind of term life. When you're seeking short-term life insurance policy plans, degree term life insurance coverage is one route that you can go.

You'll fill out an application that contains general personal information such as your name, age, etc as well as a much more comprehensive set of questions concerning your clinical history.

The brief response is no. A level term life insurance plan doesn't develop cash value. If you're looking to have a policy that you have the ability to take out or borrow from, you might discover irreversible life insurance. Whole life insurance policy plans, as an example, allow you have the convenience of survivor benefit and can build up cash money value over time, indicating you'll have extra control over your benefits while you're alive.

What is Term Life Insurance For Spouse? A Simple Breakdown

Cyclists are optional arrangements included in your policy that can offer you additional advantages and securities. Motorcyclists are a terrific way to include safeguards to your plan. Anything can occur over the course of your life insurance policy term, and you wish to await anything. By paying just a bit a lot more a month, cyclists can provide the assistance you require in case of an emergency.

This biker supplies term life insurance policy on your children through the ages of 18-25. There are circumstances where these benefits are constructed right into your plan, but they can additionally be offered as a separate addition that calls for additional payment. This motorcyclist gives an added survivor benefit to your beneficiary should you die as the outcome of a mishap.

Latest Posts

Instant Quotes Term Life Insurance

Final Expense Policy

Funeral Plans With Immediate Cover