All Categories

Featured

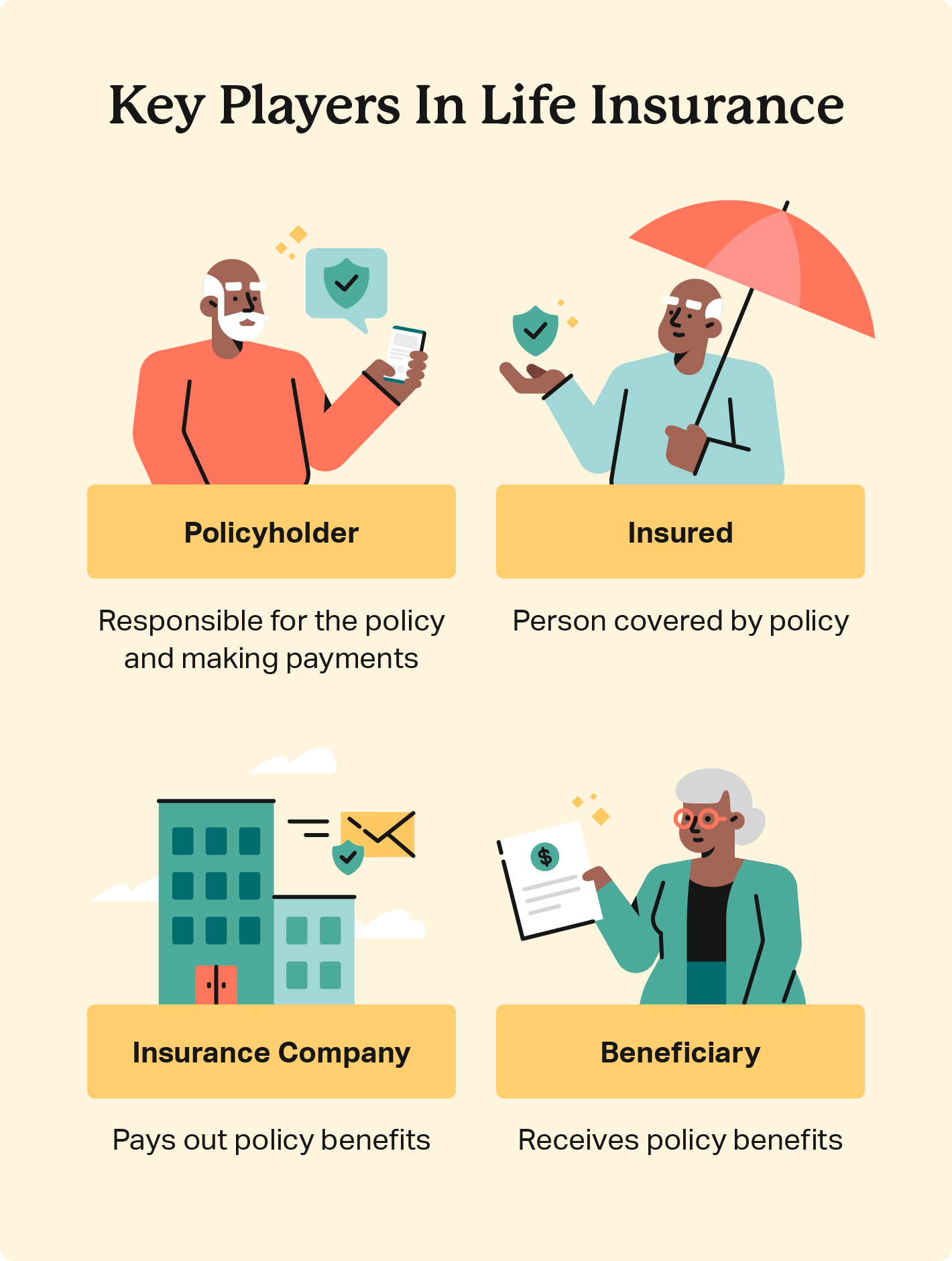

Cash worth is a living advantage that continues to be with the insurance policy business when the insured dies. Any superior financings versus the money worth will decrease the plan's survivor benefit. Protection plans. The policy owner and the insured are normally the exact same individual, yet in some cases they might be different. A business might get crucial person insurance coverage on an essential staff member such as a CHIEF EXECUTIVE OFFICER, or an insured could market their own policy to a third event for cash money in a life negotiation - Premium plans.

Latest Posts

What Is Voluntary Term Life Insurance Coverage and How Does It Work?

How Does What Is Level Term Life Insurance Work?

What does Level Term Life Insurance Vs Whole Life cover?